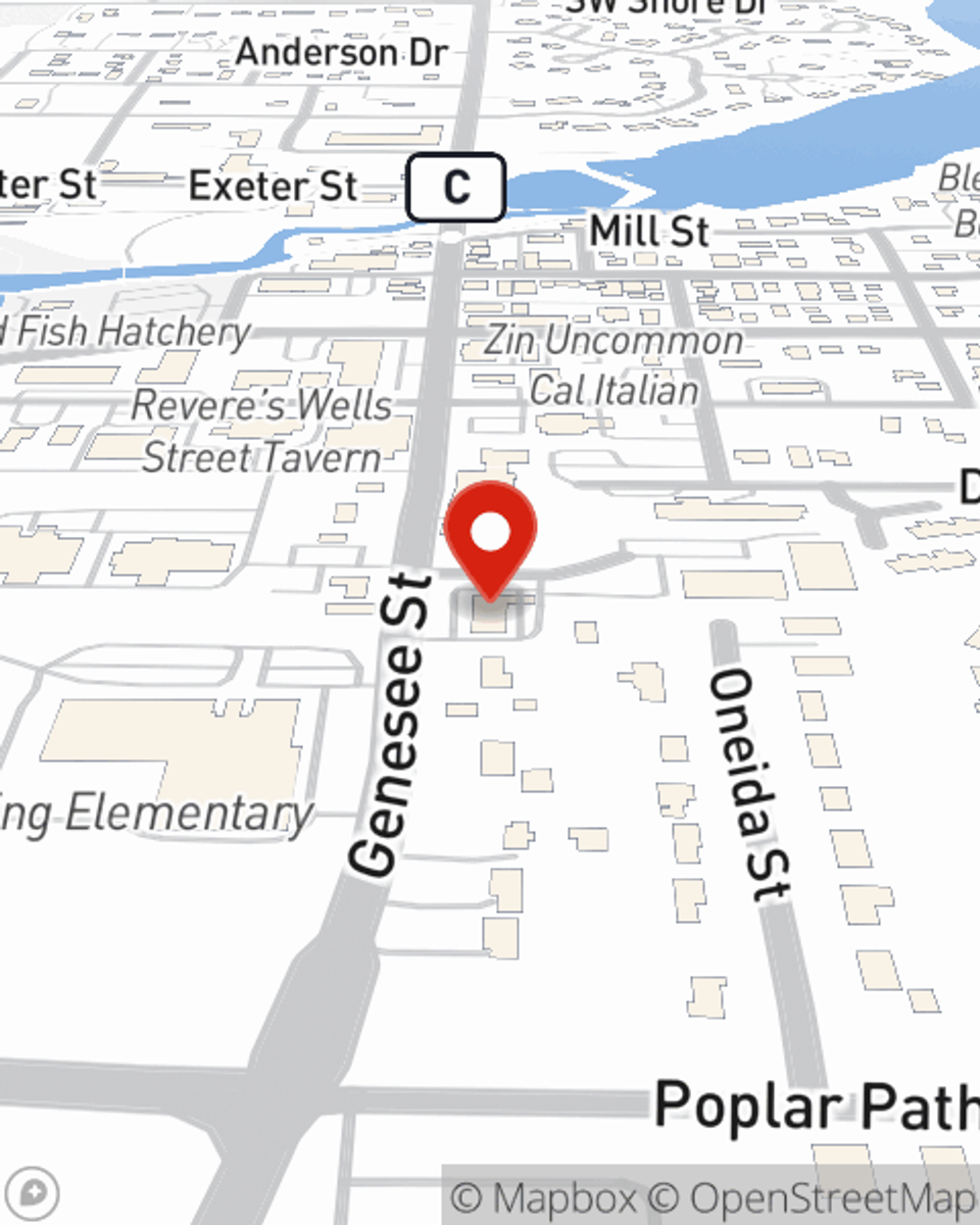

Business Insurance in and around Delafield

Get your Delafield business covered, right here!

Insure your business, intentionally

This Coverage Is Worth It.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Joe Woelfle is not unaware of the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to look into.

Get your Delafield business covered, right here!

Insure your business, intentionally

Get Down To Business With State Farm

Whether you are a barber a taxidermist, or you own a pet store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Joe Woelfle can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and buildings you own.

It's time to call or email State Farm agent Joe Woelfle. You'll quickly discover why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Joe Woelfle

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.